Legislation

HVAC Refrigeration Updates in 2024

Refrigeration Requirements The EPA and federal government has implemented the next round of refrigeration requirements, and outlined those for the next 2 decades. In previous years, R22 was phased out, in the next phase of the process R410A will be reduced and then discontinued altogether. As a Controlled Air customer, we...

Tax Credit Available on Yanmar Gas Heat Pumps Ends in 2024

We want to remind everyone that the Gas Heat Pump (GHP) systems manufactured by Yanmar qualify for the 30% tax credit, as well as for direct payments to tax-exempt entities, under the Inflation Reduction Act (IRA). This tax benefit only applies to systems installed by December 31, 2024. Due to...

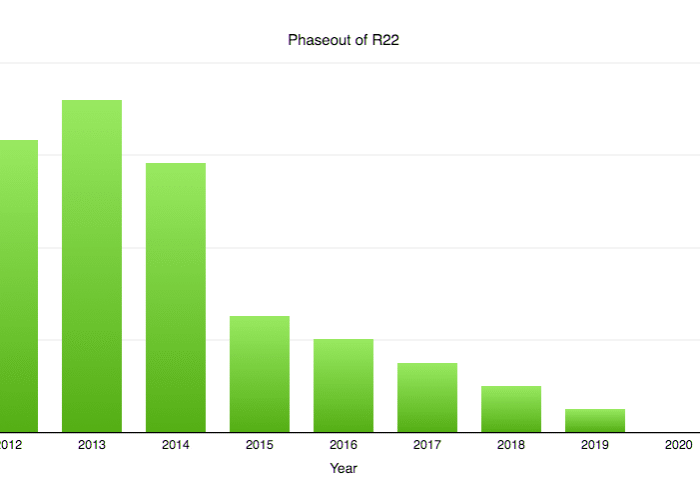

The Final Phaseout of R-22

The final phase-out of R-22 will once again be impacting supplies and prices of R-22. The U.S. Environmental Protection Agency (EPA) final phasedown schedule is as follows: Drop from 51 million pounds allowed in 2014 to 22 million pounds beginning Jan. 1, 2015. Subsequently, 18 million pounds of new and...

CEFIA Releases RFP for Cogeneration (CHP) Pilot Program

CEFIA is charged with administering a three-year $6 million dollar pilot program. The total funding remaining in the program for all selected projects under this competitive solicitation is $5 million dollars. This program will offer support for projects that are below five megawatts. However, funding will not exceed the equivalent...

Gas Conversions

Governor Malloy's $7 bil expansion of natural gas has made converting to natural gas a possibility for many homes and businesses. Currently there are no incentives to make the conversion, BUT there are incentives and rebates available for the equipment that will run on natural gas. Depending on your current...

Update on R-22 Refrigerant

The EPA has finally signed the 2012-2014 (yes a little late since it is already 2013) allocation rule for R-22, which dictates how much can be imported and produced. Here are the figures: 2012 55 mil lbs, 38% reduction 2013 63 mil lbs, 21% reduction 2014 50 mil lbs, 18% reduction The amounts allocated...

Special Rebates & Incentives Available until 12/31/2012

Governor Dannel P. Malloy today announced that $3 million in additional energy efficiency incentives are now available for residents and businesses replacing furnaces, boilers, hot water heaters and refrigerators as a result of damage from Super Storm Sandy. These incentives are only available until December 31st. The incentives will apply for...

What is happening with Energy Efficient Funding?

It is confusing at best trying to keep up with all the new legislation that is going on in the government. Some things say they are trying to increase spending and funding for energy efficiency and the next cutting it. Currently there are a few major items that are being...

Changes in 2011 for Incentives & Rebates

Changes in 2011 for Incentives & Rebates With the Economy being what it is, Connecticut made some changes to the rebates and incentives available for green energy funding. Also the utilities made some changes as well. We do our best to stay up to date about all these so that...